With that in mind, there are still a couple of advantages to hiring yourself. You'll have to diligently pay taxes from your self-employment tax to payroll tax and other associated taxes. Indeed, by not taking an owner's draw, you will not be able to get the income tax benefits that you would normally have. Instead, you'll have to hire yourself and put yourself on the company's payroll. If your LLC is taxed as a C-corporation or S-Corporation, then you will not be able to take an owner's draw from the business bank account. While a multi-member LLC business owner does not have to pay income tax, they will still have to pay self-employment tax. Reasonable compensation will be determined at that point as well, which will be delivered through Schedule K-1.Īll partners need to pay income tax in full, even if they don't make an owner's draw that month. The exact amount will be determined beforehand, when all the partners sign a partnership agreement. Instead, each partner will pay taxes themselves from the business profits. With a pass-through entity, the income is reported to the IRS, but the partnership itself is not taxable.

As a result, they are pass-through entities. One thing to keep in mind is that, unlike single-member entities that are labeled as disregarded entity, multi-member LLCs are treated as partnerships by the IRS. They write a check to transfer money from the business bank account into their personal account. For Multi-Member LLC OwnersĪ partner in a multi-member LLC can also get through an owner's draw, and the process is pretty much the same. Once tax season turns a corner, you will not have to pay separate taxes for the LLC for the amount that is transferred. In order to make an owner's draw in this case, all you have to do is write a check that goes from your LLC into your personal account. This means that, as far as the IRS is concerned, you and your business are pretty much the same entity when you are filing for personal tax return. If you are the only member of the LLC, you'll be drawing it yourself from your business account.īear in mind that single-member LLCs are seen as disregarded entities. There are also two routes here that you'll want to take. The most common option for paying yourself as an LLC owner is to get an owner's draw - which means that you are drawing from company's profits for personal use. Bear in mind that the option you go for may not only affect your personal taxes but also your business taxes. Options for Paying YourselfĪs an LLC owner, there are several ways in which you can pay yourself. General partnerships are LLCs where two people sign a business agreement. Here is what you may choose from:Ī general partnership is typically the preferred structure for a small or medium-sized company. There are different kinds of LLC out there, and these types may affect the way you get your payments. They may choose the option that works to their advantage. For example, an LLC member can decide to pay income taxes as a sole proprietorship, or they may do so as a corporation. LLCs also have better tax flexibility as compared to a corporation. That being said, LLC owners are typically labeled as LLC members. The rules on how an LLC works will differ from state to state (read which states are the best to open an LLC). In other words, their assets are protected from being seized. While a sole proprietor has their personal assets liable in the event of business failure, LLCs have limited liability protection. What Is an LLC?Ī limited liability company, also referred to as an LLC, combines the advantages of sole proprietorships with those of a corporation.

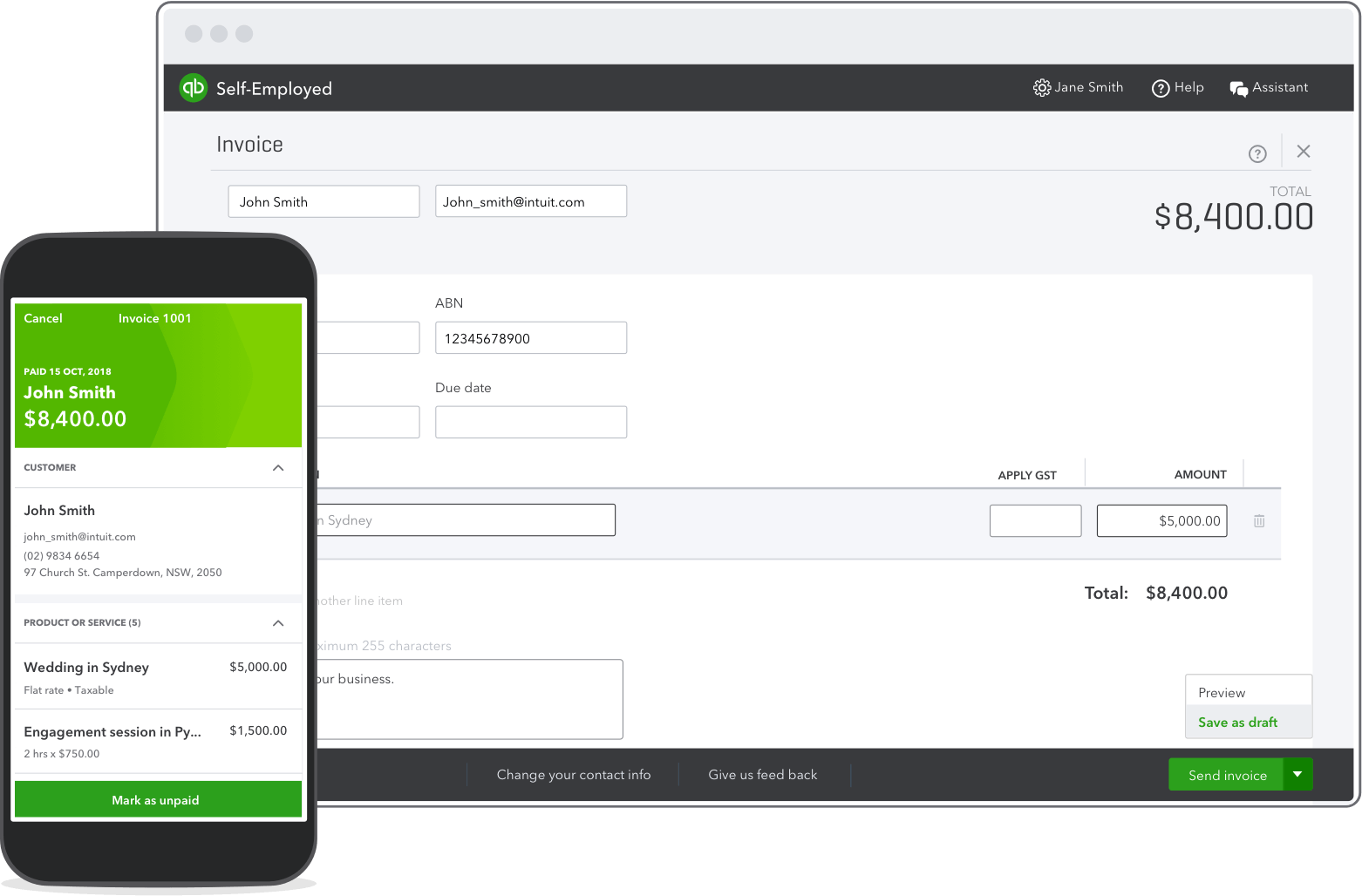

Quickbooks self employed for llc trial#

Our all in one self-employed platform uses ready-to-edit templates and an expense tracker to keep you on top of these tasks. Claim your 14-day free trial today. Note: If you are a business owner looking to manage your taxes, proposals, invoices, and contracts in one place, try Bonsai. You can treat yourself as your own employee, as long as you consider the factors and tax implications. Luckily, there are multiple ways through which an LLC owner can cover their payment. You may be the owner - but you still need to get your business income for what you are doing.

Quickbooks self employed for llc how to#

If you are starting your own business, you will eventually start to wonder how to pay yourself, LLC-wise.

0 kommentar(er)

0 kommentar(er)